M. Suhail

This tale was written on July 5 for subscribers of Studying The Markets. It has been current as of the evening of July 10, in which italicized alongside with the technological chart.

Household Depot (NYSE:Hd) shares have plunged in 2022 owing to soaring curiosity costs which have assisted to sluggish the housing current market. On major of that, larger inflation prices have eaten absent at some of Residence Depot’s gross margins and manufactured these margins a lot far more volatile over the earlier 12 months.

Estimate Discrepancies

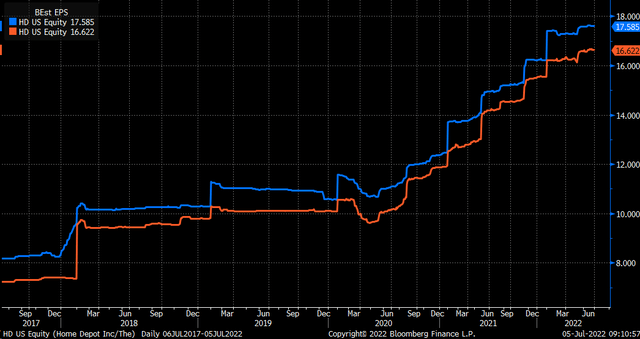

Irrespective of a weakening housing market and described margin volatility, analysts’ earnings estimates for Residence Depot’s fiscal 2023 and 2024 are keeping up. Analysts are forecasting earnings for Household Depot to increase to $16.62 for each share in 2023 and $17.59 in 2024. That is a expansion fee of 7.02% in 2023 and 5.79% in 2024.

Bloomberg

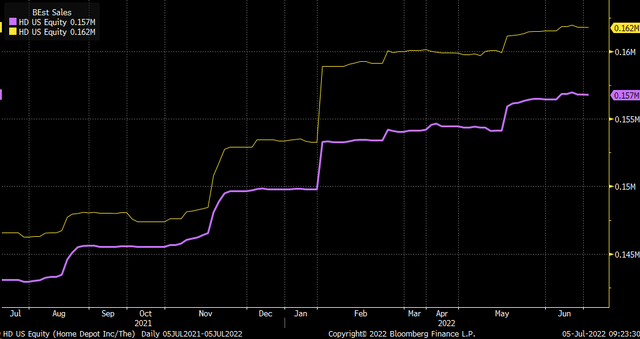

Even profits estimates for Dwelling Depot keep on to increase. By 2023 analysts see product sales achieving $156.79 billion and $161.76 billion in 2024. That would advise that earnings in 2023 will mature by 3.73% and 3.17% in 2024.

Bloomberg

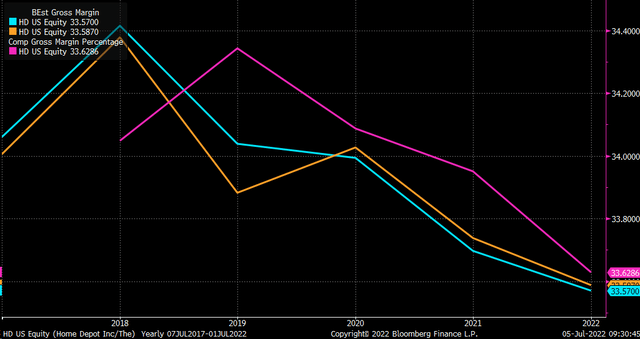

Meanwhile, analysts see gross margins staying all-around 33.6% in equally 2023 and 2024. That is approximately flat to in which gross margins had been in fiscal 2022 when they had been at 33.62%. What is odd is that revenue expansion is envisioned to be substantially slower than earnings expansion, which would recommend analysts see margins expanding somewhere, and dependent on gross margins estimates, it just isn’t obvious to be genuine.

Bloomberg

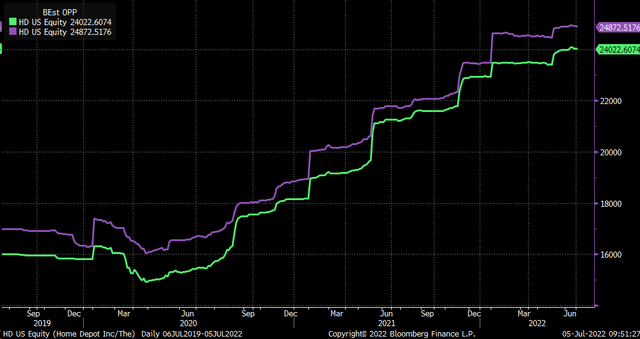

Operating revenue are forecast to rise by 4.26% in 2023 to $24.02 billion and yet another 3.54% in 2024 to $24.87 billion. Again, this development rate is predicted to be a lot quicker than profits expansion in both of those yrs, pointing to operating margin enlargement, suggesting that analysts see expenditures coming down someplace.

Bloomberg

What is odd right here is that earnings progress is continue to considerably bigger than working profit advancement. That would counsel that analysts’ earnings estimates are way too superior or that the firm will be buying again ample inventory in the coming two several years to produce earnings advancement that exceeds earnings growth and working gain progress.

A Massive Wager The Shares Drop

The discrepancy in estimates is primary an individual to make a pretty aggressive and bearish wager on Dwelling Depot. On July 5, the open up curiosity for the August 19, $210 places, elevated by around 22,300 contracts. The data reveals that the set contracts were being purchased on the Question for $1.34, implying Property Depot is trading at or below $208.66 by the expiration date. That would be a huge decrease in Residence Depot inventory from its existing cost of about $277 on July 5. It is also a big wager with nearly $3 million premiums paid.

The odds of the inventory slipping that sharply around the up coming thirty day period and a 50 % seem definitely lower. This bearish wager seems to be a affordable way for another person to get brief the fairness, with a small cash outlay.

Technicals Point To Reduce Price ranges

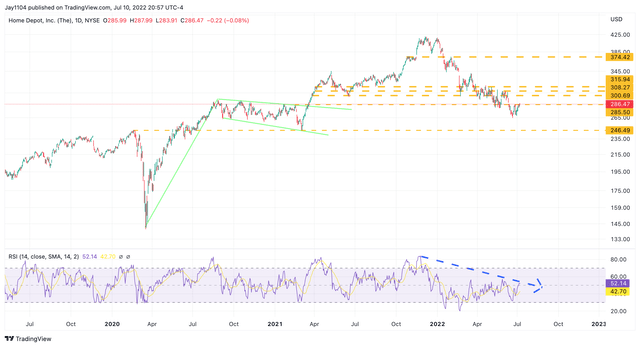

From a complex standpoint, a decline beneath $210 isn’t going to feel likely, but a drop to all-around $245 does seem to be possible. That would choose the stock back again to its pre-pandemic highs. The equity recently fell beneath assist at $285, and that cost place has turn out to be a amount of resistance. Provided the sharp run higher in the inventory starting in March 2021, Household Depot will not have much guidance until that $245 spot on the specialized chart.

In addition, the relative toughness index is in a pronounced downtrend, suggesting a good deal of bearish momentum in the inventory over the close to term.

Considering the fact that this story was published on July 5, the inventory has hovered all over resistance in the $285 area. To this position, it has failed to drive previously mentioned the $285 region on 3 attempts. Additionally, the RSI stays in a quite steep downtrend.

Updated on July 10, 2022 (TradingView )

Dwelling Depot has definitely been a significant performer more than the past two several years, but it seems that reliable overall performance might conclusion. There show up to be too lots of discrepancies in analysts’ estimates at this place in the financial cycle to propose the shares rally. Larger input expenditures and weakening purchaser demand from customers should lead to margin erosion in this business enterprise model, not margin expansion. Ideal now, except Home Depot is likely to be acquiring a large amount of stock in the close to expression, earnings estimates seem way too higher.

More Stories

Get your garage ready for holiday prep!

Best Essential Holiday Decor – Maison de Pax

Insulation FAQ: What is Blanket Insulation