patty_c/iStock Unreleased by way of Getty Illustrations or photos

Investment Thesis

The Household Depot, Inc. (NYSE:Hd) inventory has arrive under important strain above the final handful of months. The market has been anxious above a multitude of risks relating to the macro-setting that has thrown a curveball to traders. The worsening inflation, more quickly than anticipated rate hikes, and the Russia-Ukraine conflict took their toll as High definition inventory fell 28% from its December highs.

Nonetheless, we think Hd stock valuation has improved significantly, as it reverted to its 5-year mean throughout quite a few metrics. In addition, it is also markedly underneath the consensus selling price targets (PTs).

As a result, we assume Hd stock’s defensive FCF profile can endure the hazards highlighted earlier mentioned. Consequently High definition investors can contemplate taking the opportunity to include publicity just before the sector realizes its overreaction.

A Drop As well Significantly In Property Depot stock’s Valuation?

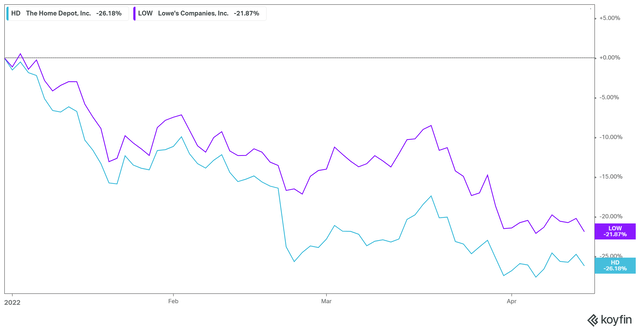

High definition inventory YTD effectiveness % (koyfin)

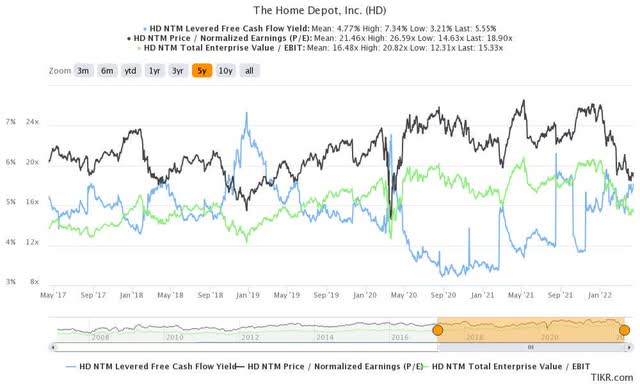

Hd stock valuation metrics (TIKR)

Hd stock has been buffeted since the commence of 2022 as the macro and geopolitical headwinds intensified. As a outcome, High definition stock has misplaced -26.2% YTD, far more than Lowe’s (Small), as its inventory fell 21.9%. Notably, both shares have fallen markedly in advance of the SPDR S&P 500 ETF’s (SPY) YTD decline of 7.5%. House Depot also referred to these headwinds in its 10-K, as it extra (edited):

Russia’s invasion of Ukraine and other geopolitical conflicts, as well as any similar worldwide response, may exacerbate inflationary pressures.

Immediate and considerable variations in commodity and other price ranges, and our capacity to pass them on to our consumers or handle them by our portfolio approach, could have an impact on the demand for our goods, our gross sales and our earnings margins.

Our economic efficiency depends drastically on the steadiness of the housing and household advancement markets. Adverse disorders in or uncertainty about these markets could adversely influence our customers’ self-assurance or economic problem, creating them to determine in opposition to getting dwelling improvement items and providers. (Residence Depot’s FY21 10-K)

Thus, buyers would be remiss in disregarding these headwinds, no issue their self-assurance in the resilience of House Depot’s Professional and Diy industry. On the other hand, the sizeable slide in its inventory price has also lowered its valuation significantly. For instance, High definition stock last traded at an NTM FCF produce of 5.6% (5Y mean: 4.8%). Moreover, its NTM normalized P/E and NTM EBIT multiples have reverted down below their 5Y necessarily mean.

Also, the median P/E (26.4x) of the dwelling improvement retail marketplace has also dropped beneath its 10Y indicate of 30x. Therefore, however justified, we consider that the current valuation compression experienced already priced in the influence of these headwinds.

Cautious Direction Is Prudent

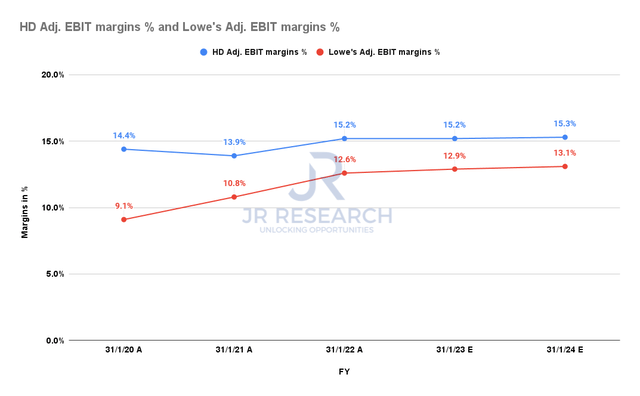

Dwelling Depot Adj. EBIT margins % (S&P Cash IQ)

Some traders ended up unhappy with Dwelling Depot’s guidance on its profitability for FY22. The organization highlighted again in its FQ4 card (edited): “Working margin roughly flat with FY21. Diluted EPS advancement to be in the lower solitary digits.”

The consensus estimates have also mirrored the firm’s cautious guidance. Investors can notice the “flattish” running leverage gains from FY21, with an adjusted EBIT margin estimate of 15.2%. In comparison to Lowe’s slight improvement of 12.6% to 12.9%, some buyers named out Home Depot’s weaker advice.

However, Home Depot emphasised that traders ought to not predicate their observations on the company’s around-term direction, provided the headwinds. In addition, the firm has also been investing in the Pro segment. These kinds of investments could perhaps compress margins in the close to time period. Having said that, Property Depot believes that it could experience sizeable extended-term benefits. CFO Richard McPhail accentuated (edited):

We realized that there are shopper wallets out there that are a lot further than we ever expected. For example, we had a customer who was a $50K buyer a 12 months. We believed we have been receiving our truthful share of their company. We opened up our flatbed distribution centre, and we are now carrying out $500K a 12 months. We had no idea they ended up this significant.

If our product or service blend were being static, we would not see substantially fluctuation in our margins, most likely. But what we have in entrance of us is the chance to increase in this $900B+ marketplace in approaches that we’ve in no way been in a position to ahead of.

It signifies that — get revenue from our flatbed distribution facilities. Very well we know that purchaser that grew from $50K to $500K is still shopping throughout our assortment. We will have possibilities in categories that have over business average gross margin. (J.P. Morgan’s 8th Once-a-year Retail Round-Up Convention)

Is Hd Stock A Get, Offer, Or Keep?

Hd stock consensus price targets Vs. inventory general performance (TIKR)

Traders can glean that the most conservative rate targets (PTs) experienced continuously supported High definition inventory above the past five yrs. But, High definition stock final traded at a stage that was well in advance (19.2%) of the most conservative PTs of $255. Moreover, the ordinary PTs have also been revised downwards, as the Street turned extra careful with the headwinds mentioned before.

For that reason, we think the stock appears very well-balanced, with the destructive sentiments priced in.

As this kind of, we rate Hd inventory as a Acquire.

More Stories

Best Essential Holiday Decor – Maison de Pax

Insulation FAQ: What is Blanket Insulation

How to Unlock the Bedroom Door?