Justin Sullivan/Getty Images News

AMD Financials

For the Q1 2022 period ending March 26, Advanced Micro Devices (NASDAQ:AMD) reported record revenue of $5.9 billion grew 71% YoY and 22% QoQ. In the Computing and Graphics segment, the company achieved record Revenue $2.8 billion, up 33% YoY driven by Ryzen and Radeon processor sales. According to the company’s earnings press release:

- In Notebooks, record mobile processor revenue for AMD was driven by the launch of its Rembrandt Ryzen 6000 mobile processors that extend the leadership compute, gaming and battery life capabilities of its mobile processors.

- In Desktop, AMD expanded its processor portfolio with the introduction of seven new Ryzen CPUs, including the Ryzen 5800X3D, which is the industry’s fastest gaming CPU and first desktop processor featuring 3D stack triplets.

In the Enterprise, Embedded and Semi-Custom segment, record revenue was $2.5 billion, up 88% YoY and 13% QoQ driven by record EPYC processor, semi-custom and embedded revenue.

- Cloud revenue more than doubled year-over-year as hyperscalers expanded their internal infrastructure deployments, and 70 new AMD-powered instances launched from Alibaba (BABA), Amazon (AMZN), Baidu Cloud (BIDU), Microsoft Azure (MSFT), Google (GOOG), and others. There are now more than 460 AMD-based cloud instances available from the largest hyperscalers, with additional instances on track to launch in the coming quarters.

AMD expects Q2 2022 revenue to be between $6.3 billion and $6.7 billion, compared to estimates of $6.36 billion. The YoY increase is expected to be driven by the addition of the Xilinx acquisition and higher server, semi-custom and client revenue.

AMD also raised its full-year guidance, saying it now expects to generate $26.3 billion in revenue, up 60% year-over-year, up from a previous outlook of 31%. The company expects non-GAAP gross margins to be 54% during the year, up from a prior outlook of approximately 51%.

Market Shares

Unit Shipments

Intel (INTC) and AMD share a common start, so it isn’t surprising that their focus continues. Both were both founded from former employees of Fairchild Semiconductor. Intel was created in 1968 by Fairchild Engineers Bob Noyce and Gordon Moore, while AMD was founded in 1969 by former Fairchild Executive Jerry Sanders.

Intel had largely dominated the CPU market segment starting from the 2006 release of their Core microarchitecture (marketed as “Core 2-Duo”), after abandoning the Pentium 4.

AMD focused on lower-cost, budget-friendly middle- and low-range chipsets, while Intel chips had the reputation of being more stable and higher performance.

In 2011, AMD had a major design failure with their Bulldozer architecture. In the Bulldozer design, it shared a Floating Point Unit between two cores which held it back under certain workloads. Intel’s Core architecture did not have this issue and became dominant in the market for a very long time with AMD relegated to the budget PCs.

Intel was also experiencing problems at that time. Intel’s made minor tweaks to its Skylake microarchitecture since 2015, and was stuck at the 14nm process since 2014, dropping the ball on their 10nm design process which was supposed to release in 2015. After several delays, the company assured that it would deliver 10nm processors to market in 2017. That never happened.

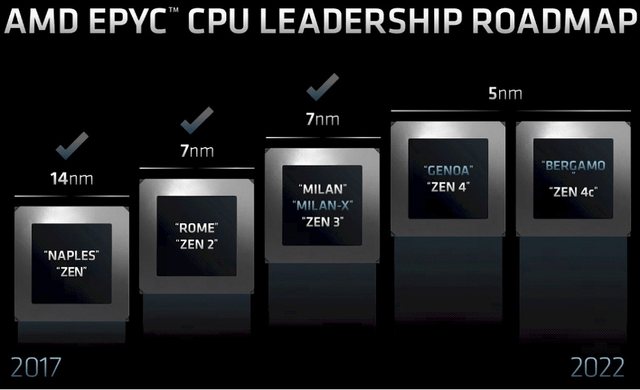

That changed in 2017, when AMD finally released a new, enthusiast-friendly architecture, codenamed Zen. The Zen architecture brought power and thermal efficiency back into line while rocketing raw multi-threaded performance noticeably above Intel’s best offering.

The first-generation ZEN was the highly successful Ryzen microprocessor, a more affordable alternative to the best of Intel’s chips. The Ryzen microprocessor was a completely new design capable of breaking overclocking records while still being affordable for the budget-conscious consumer. The Ryzen was the start of AMD increasing market share against Intel. The Zen architecture delivers more than 52% improvement in instructions per cycle (clock) over the prior-generation Bulldozer AMD core, without raising power use.

Prior to 2017, dual core processors and quad core processors were the mainstream for years, but that all changed after AMD’s breakthrough in the market. Within two years, consumer processors advanced from quad core CPUs to 28 and 32 core CPUs. The slated release of new manufacturing techniques, such as AMD’s 7nm manufacturing process versus Intel’s stalled 14nm, also accelerated AMD’s product competitiveness.

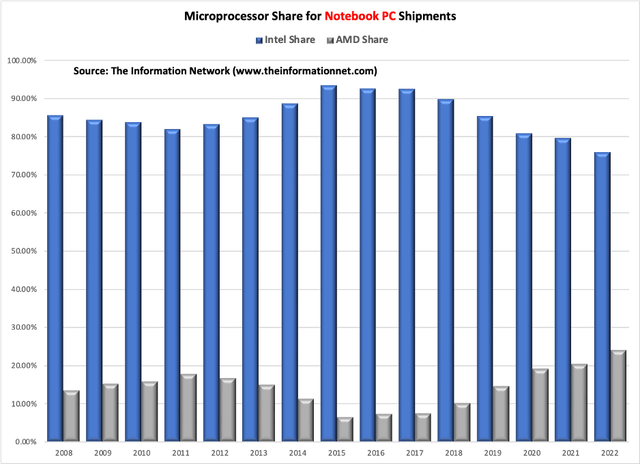

Chart 1 shows microprocessor share of Notebook PC unit shipments for AMD and Intel between 2008 and estimated 2022. We see the low point in AMD share during 2015 and then the increase when AMD introduced the Zen architecture that was accepted by the user community.

The Information Network

Chart 1

In April 2022, AMD launched the Ryzen 4000 series of CPUs for budget-oriented users. Unlike the Ryzen 3000 series CPUs which are based on “Matisse” cores, these new Ryzen 4000 series desktop CPUs were based on “Renoir” cores and are essentially Accelerated Processing Unit (“APU”) with the integrated graphics disabled.

According to AV Forums:

“Zen 3 powers Ryzen 5000 mainstream desktop processors (codenamed “Vermeer”) and Epyc server processors (codenamed “Milan”). Zen 3 uses TSMC’s 7 nm process for the chiplets and GlobalFoundries’s 14 nm process for the I/O die on the server chips, and the 12 nm process for desktop chips.”

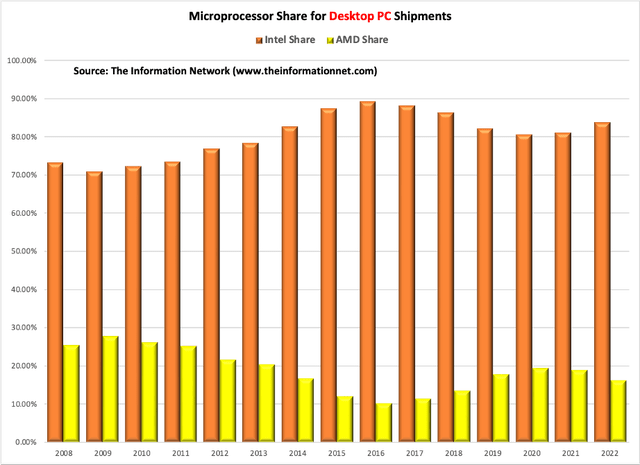

Chart 2 shows a similar trend in desktop PC share with notebook PC share. But I see a recovery in erosion of Intel’s shipments in 2020 based on the company’s new roster of desktop CPUs. Intel has expanded its 12th Gen Alder Lake lineup with a total of 22 new desktop CPU options to select from within the Core i9, Core i7, Core i5, Core i3, Pentium, and Celeron SKUs segments.

The Information Network

Chart 2

The Epyc server line of chips based on Zen 3 is named Milan and is the final generation of chips using the SP3 socket. Epyc Milan was released on March 15, 2021.

The Epyc server chips will compete with a new Intel server roadmap presented at its Investor Day 2022. Intel’s Sapphire Rapids will feature the chipmaker’s Golden Cove cores and Intel 7 node, previously known as the 10nm Enhanced SuperFin process. The Sapphire Rapids-SP processor has 56 cores and 112 threads and has 112MB of L2 cache and 105MB of L3 cache. The highest tier EPYC 7003 has up to 256MB of L3 cache. However, Intel is also readying Sapphire Rapids with up to 64GB of HBM2e memory; meanwhile, AMD has prepared its Milan-X chips with 512MB of 3D V-Cache.

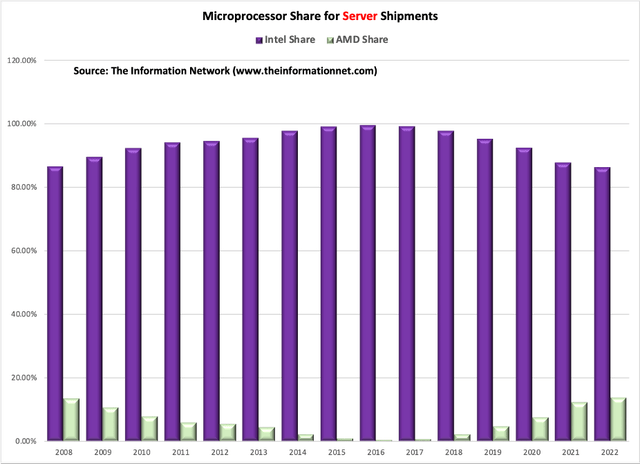

Chart 3 shows that the Intel chips may slow the erosion in its server slide in 2022, according to The Information Network’s report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips.”

The Information Network

Chart 3

Investor Takeaway

AMD has been playing catch-up against Intel in the microprocessor market, and in the past few years has been gaining market share, which is currently at 20% and below depending on sector. In the server sector, AMD and Intel seem to be leapfrogging each other by introduction a “superior chip” on almost a quarterly basis.

In my opinion, the battleground is not with the chip designers, but with the chip manufacturing prowess. I already discussed Intel’s inadequacies at the stalled 10nm node that enabled AMD to gain market in 2015. This raises an important question – can Intel make the chips it needs to compete and if so when?

Hardware Times noted in a recent article:

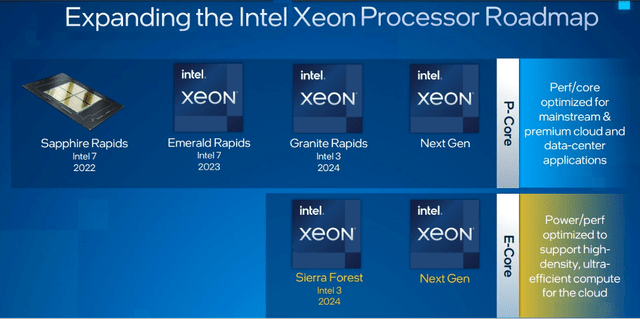

“At its Investor Day 2022, Intel unveiled a revised, amped-up roadmap with an aim to retake architectural and process leadership from arch-rivals AMD and TSMC (TSM), respectively.”

According to this roadmap in Chart 4, Intel is set to release its 3nm process node in 2024 with Granite Rapids and Sierra Forest, and its 20A (2nm) process the same year with Arrow Lake in the client segment.

Intel

Chart 4

AMD is using TSMC’s 7nm node currently and moving to the 5nm on its Zen 4 architecture, as show in Chart 5.

AMD

Chart 5

Based on Intel’s roadmap in Chart 4, the 3nm Intel Granite Rapids and Sierra Forest server processors will clash with AMD’s 3nm Zen 5 and Zen 5c based Epyc CPUs in 2024.

Finally, there is increasing macroeconomic and geopolitical pressures. On the macro side, if a consumer feels poor (and consumer sentiment in the U.S. in March was at a decade low as inflation erodes incomes, heightened by uncertainty over Russia’s invasion of Ukraine), the consumer doesn’t buy items containing computer chips, and they are in every electronic gadget.

The growing inflationary pressures are undermining consumer spending power. The U.S. inflation rate rose to 8.5% for the 12 months ended March 2022 – the highest since December 1981.

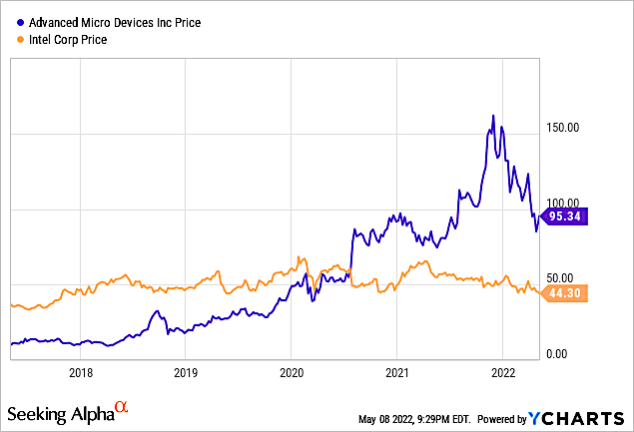

From a financial standpoint, AMD’s and Intel’s stock performance for the 5-year period are shown in Chart 6. It is noted that Intel’s price has been essentially flat over the period. AMD’s stock growth has been lofty.

YCharts

Chart 6

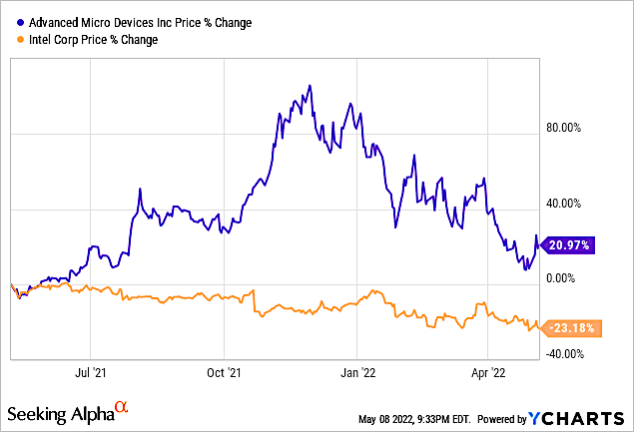

Chart 7 shows Price % change for a 1-year period for the two companies. AMD’s share price increase of 21% clearly outgrew Intel’s -23%.

YCharts

Chart 7

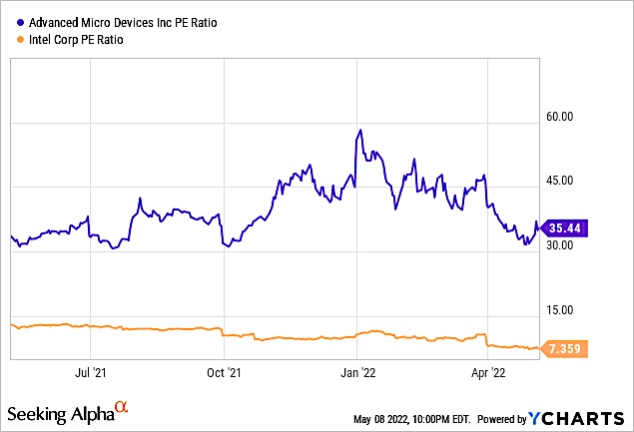

AMD and Intel trade at wildly different valuations; AMD is nearly five times as expensive on a price-to-earnings basis, but that’s arguably justified because of its growth, as shown in Chart 8.

YCharts

Chart 8

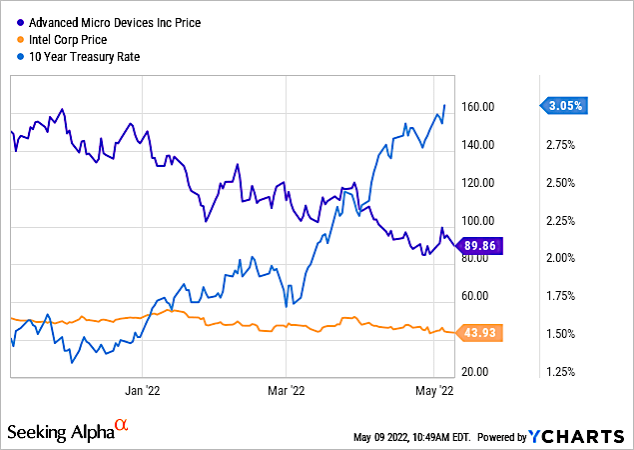

Inflation is eroding technology share price as the Fed responds and the 10-year treasury continues to increase since the start of 2022. Chart 9 shows that AMD has been impacted by the 10 year, decreasing since the end of November 2021. Interestingly, Intel has not been impacted.

YCharts

Chart 9

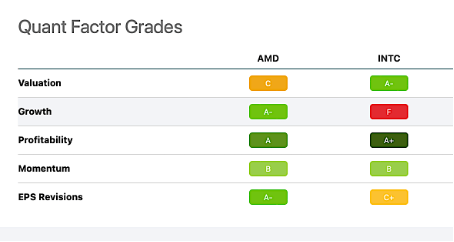

Chart 10 compares to Seeking Alpha’s Quant Factor Grades for AMD and Intel. AMD has a Quant ranking of 6 out of 64 semiconductor companies compared to Intel with a ranking of 29 out of 64.

Seeking Alpha

Chart 10

AMD is clearly the better choice of the two companies with its increasing market share since 2017. In Server CPUs, both companies continue to crank out advanced products, and the battleground has shifted from architecture design to who can actually make the chips at the <7nm node. TSMC has already proven itself and manufacturers AMD CPUs. Intel has performed badly in the past with delay after delay at the 10nm node. Nevertheless, Intel has been in production with its Alder Lake at the Intel 7 node since the end of 2021.

However, there is a “rumor” from magazine DigiTimes that Intel is considering manufacturing its 14th Gen Core “Meteor Lake” CPUs (planned with Intel’s I4 process) at least partly using TSMC’s 5nm process to mirror Apple’s M1 series of chips. We will see.

A significant issue with technology stocks is the inverse relationship between share price and the 10-year Treasury, which can be seen in Chart 16 above. The 10-year has been increasing since the inflation rate in the U.S. has been increasing. Until the 10-year Treasury moderates, there is pressure on AMD shares as the bottom may not be imminent.

The fundamentals of AMD are strong and I rate it a buy. However, during these extraordinarily uncertain times of high inflation, plummeting stock market, and geopolitical problems with Russia, I recommend for those who own the stock, dollar cost averaging may be a solution for investors with long-term investment plans who want to take advantage of the dip in price. For investors who do not own the stock, buying at the bottom is never known, particularly when we see 1000 point price swings from one day to the next. Thus, I suggest waiting instead for AMD’s share prices to level out for at least one to two months before buying.

More Stories

Are Solar Panels a Good Investment?

Exposing The Most Common Flooring Myths

Foam Jacking vs Mud Jacking, Concrete Raising Systems