A large story around the past two several years has been the rise in household rates. There are many variables at participate in. Restricted offer is one. An influx of folks moving to extra attractive areas is an additional. But growing desire premiums are threatening to stymie the housing market. There are even fears that some of the latest gains could be reversed.

That has pushed home improvement merchants Household Depot (High definition -1.60%) and Lowe’s (Very low -1.85%) well down below the highs they attained at the finish of very last calendar year. But people fears may possibly be giving traders an prospect. Is a single of them better than the other? Wall Road thinks so. And these charts show why.

Image source: Getty Photographs.

A single is normally additional expensive than the other

For the earlier 10 years, Wall Road has been willing to spend a better valuation for Residence Depot than for Lowe’s. As the valuation of the total inventory current market oscillated, the two household enhancement shops did a dance of remarkable predictability. Resembling poles of two magnets repelling just about every other, the price tag-to-product sales ratios saved their distance.

Hd PS Ratio info by YCharts

It is also regularly additional worthwhile

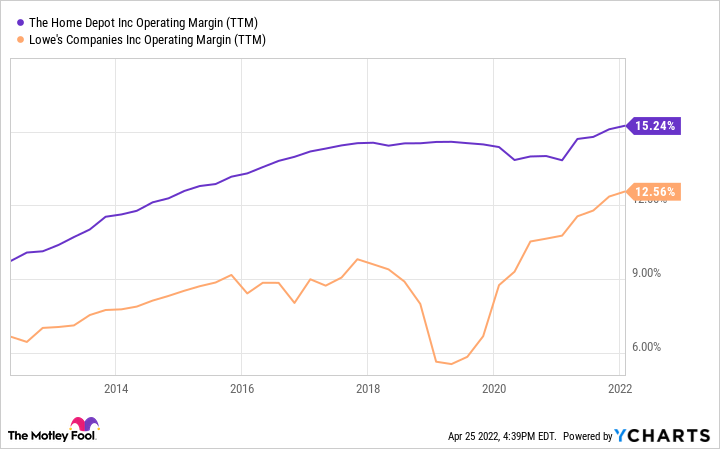

Just one great explanation is Home Depot’s profitability. In excess of that ten years, its running margin stayed at the very least a person-fifth increased than that of Lowe’s. The company a short while ago warned that revenue margins would suffer as expenditures surge.

Management went so significantly as to constitution its possess cargo ship to steer clear of the snarled international provide chain. Traditionally, Lowe’s has invested extra on bills like income, advertising and marketing, and administrative capabilities this kind of as human assets and accounting. In 2021, the variance was about a tiny much more than 2% of income — roughly the gap in running margin.

High definition Functioning Margin (TTM) details by YCharts

In sharp distinction to historical past, the the latest update at Lowe’s was optimistic. In February it elevated its entire-12 months estimates for gross sales and revenue.

And it’s in a far better posture to handle its financial debt

A person place in which Lowe’s appears a lot more desirable is the total of financial debt it carries in contrast to Residence Depot. It has $30 billion in blended brief- and extended-phrase credit card debt on its balance sheet. Home Depot has $45 billion.

But digging a little further reveals that House Depot is in a more robust money place, due to the fact it generates approximately twice the earnings right before curiosity and taxes (EBIT). That usually means its situations interest earned ratio — the variety of occasions the EBIT can address annual desire payments — is a great deal better.

Lower Instances Interest Earned (TTM) knowledge by YCharts

It has grown quicker, much too

All of this neglects the one particular metric several investors prioritize above all some others: expansion. Right here far too, Home Depot wins. Neither organization is in hypergrowth mode, and both benefited a ton for the duration of the pandemic from consumers’ willingness to invest on housing. But more than the earlier five- and 10-12 months intervals, the top rated line at Loew’s has expanded at a slower tempo.

Hd Earnings (TTM) information by YCharts

Which just one pays you extra to own shares?

Investors may possibly hope Lowe’s to make up for these perceived shortfalls by having to pay a better dividend to shareholders. They would be mistaken. Home Depot’s distribution much exceeds that of Lowe’s. It has for most of the previous decade.

Hd Dividend Yield info by YCharts

That does not account for all of the means to return cash to shareholders. Lowe’s has performed substantially more inventory buybacks in the past couple years. In simple fact, it has repurchased 17% of shares outstanding in just the previous a few many years. Household Depot has acquired again just 6%.

Lowe’s also has additional space to boost the dividend in the long term. It sends considerably less than just one-quarter of profits back again to shareholders as dividends. For Dwelling Depot, the amount is about 4-fifths. Still, both of those can quickly do it for the foreseeable upcoming.

Is the shifting of the guard around?

If you happen to be searching to incorporate a person of the massive-box property enhancement shops to your portfolio, the historic metrics make a powerful situation for Residence Depot more than Lowe’s. But that could be transforming. Differing 2022 outlooks and an intense buyback software have Lowe’s seeking and sounding like the previous House Depot that Wall Road fell in like with.

The two present investors publicity to an business at the coronary heart of the American economy. With powerful money return programs, reliable margins, and workable debt, there is no improper decision. But House Depot has proved it can execute more than time. That is why I would lean toward it if forced to opt for. Of system, there is no rule in opposition to obtaining each.

More Stories

New launches from &Tradition: Layers of Materiality

A tactile apartment by Jan Hendzel Studio at Town Hall Hotel – LDF 2022

Best Patio Heaters Fall 2022 / Spring 2023